The Complete Guide to Angi Leads for Home Service Contractors in 2026

Everything contractors need to know about Angi in 2026: real costs by trade, the shared lead model, lead disputes, legal settlements, and honest strategies for making it work as a supplemental lead source.

Angi remains the largest lead generation platform for home service contractors in the United States, commanding roughly 40% market share among lead aggregators. Yet it carries one of the most controversial reputations in the industry.

Contractors face a paradox: the platform’s massive reach (over 150 million homeowners served) makes it impossible to ignore, while its shared-lead model, $14+ million in regulatory settlements, and approximately 90% negative contractor reviews online demand careful evaluation before signing a one-year contract.

This guide provides everything you need to make an informed decision about Angi in 2026.

Understanding What Angi Actually Is in 2025-2026

The modern Angi emerged from a complex corporate history. Angi Inc. now operates as a fully independent public company following IAC’s spin-off completed on April 1, 2025. The platform combines three previously separate businesses: the original Angie’s List (founded 1995), HomeAdvisor (merged 2017), and Handy (acquired for pre-priced services).

Today’s Angi operates three distinct products for contractors:

- Angi Leads (formerly HomeAdvisor): Pay-per-lead model where contractors pay $15-$120+ per homeowner contact, with leads typically shared among 3-8 competing contractors

- Angi Ads (formerly Angie’s List advertising): Pay-per-click advertising with an annual membership fee

- Angi Services (formerly Handy): Pre-priced, on-demand services where homeowners book and pay directly

When you sign up for “Angi Leads,” you’re essentially using the former HomeAdvisor system. Emails may still display “HomeAdvisor Lead” as the sender.

Setting Up an Angi Pro Account

The Application Process

Creating an Angi pro account begins at signup.angi.com/pro:

- Enter business information (name, ZIP code, primary service category)

- Define your service area and specific trades offered

- Provide contact details and verify email address

- Agree to Terms of Service and complete business verification

- Build out your business profile with hours, description, and photos

- Set your monthly lead budget and payment method

- Complete background check (required for Angi Approved status)

The background check applies only to business owners, not individual employees, and typically completes within 1-3 days.

Fees and Membership Costs

The cost structure includes multiple components:

| Fee Type | Amount | Notes |

|---|---|---|

| Basic listing | Free | Limited visibility, no lead generation |

| Angi Ads membership | ~$300/year | Required for advertising program |

| Angi Leads membership | ~$300/year | Required for lead generation |

| Per-lead costs | $15-$120+ | Varies by trade, location, job size |

| Minimum lead requirements | $15 “dead lead” fee | Charged if monthly quota not met |

| Early termination | 35% of contract value | 1-year contract standard |

Critical contract terms: Contracts auto-renew unless cancelled 60+ days in advance. Annual cost increases of up to 10% may be applied at renewal. Refunds for bad leads are issued as credits, not actual refunds, with a limit of approximately 5 credits per territory.

How Angi’s Lead Generation Actually Works

The Shared Lead Reality

The standard Angi lead is shared among 3-8 contractors simultaneously, with roofing contractors reporting leads sold to as many as 16 competing businesses. Each contractor pays full price for the same homeowner contact.

This creates the core economics problem with Angi: A $50 lead shared among 4-5 contractors means an effective cost of $200-$250 per 20-25% chance at winning the job.

Shared lead conversion rates average 13-20%, compared to exclusive lead conversion rates of 27-30%—nearly double.

The “Homeowner Choice” Shift (2025)

The most significant recent change: as of January 13, 2025, nearly all homeowners now actively choose which contractors to match with, rather than Angi automatically distributing leads. This fundamentally changed lead quality—contractors receiving leads now know the homeowner specifically selected them.

Homeowner NPS rose 11 points when they choose pros themselves, and contractor self-reported win rates increased by 60%+.

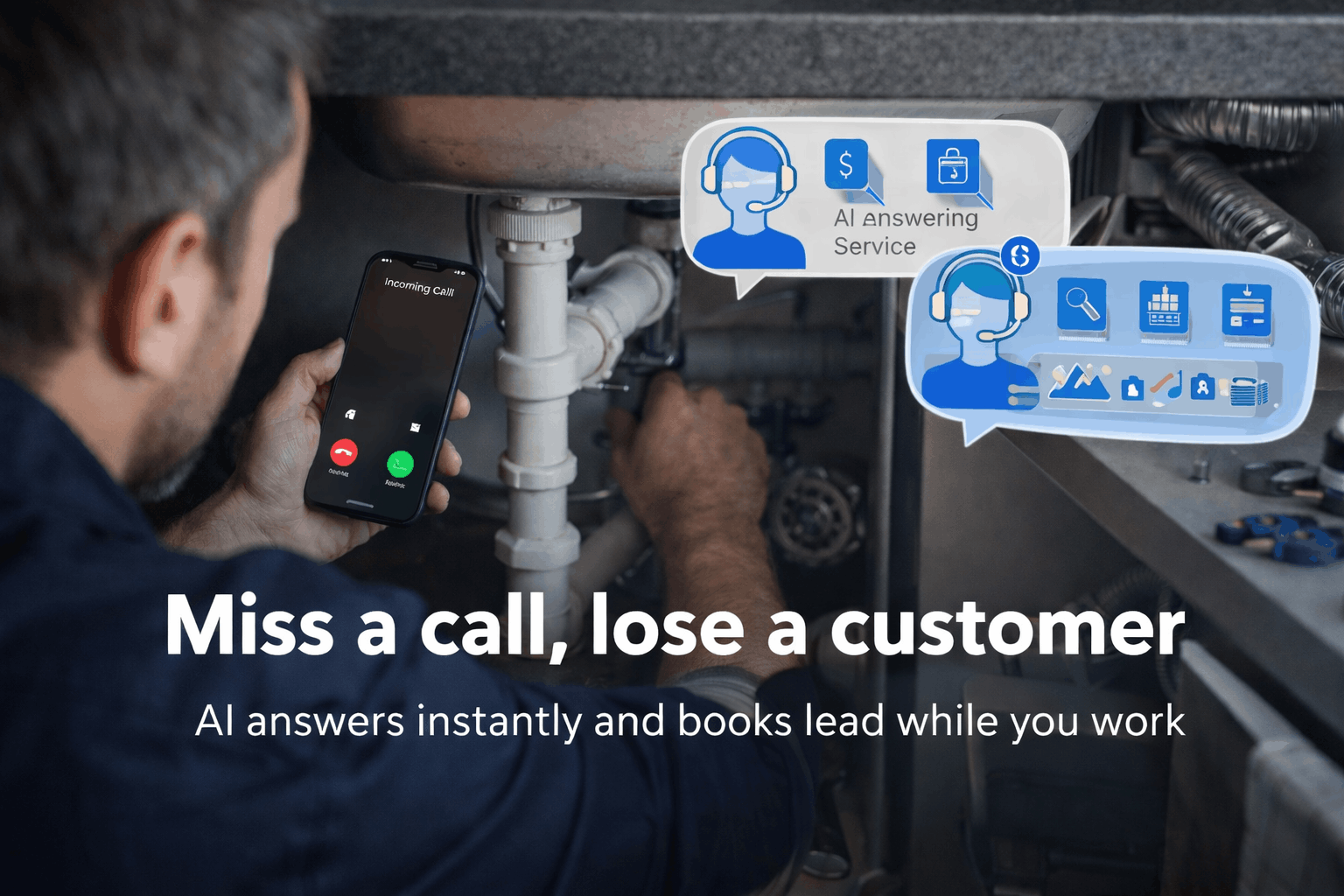

Speed-to-Lead is Everything

Industry data shows 35-50% of sales go to the contractor who calls first. Angi’s own documentation emphasizes responding within minutes, not hours.

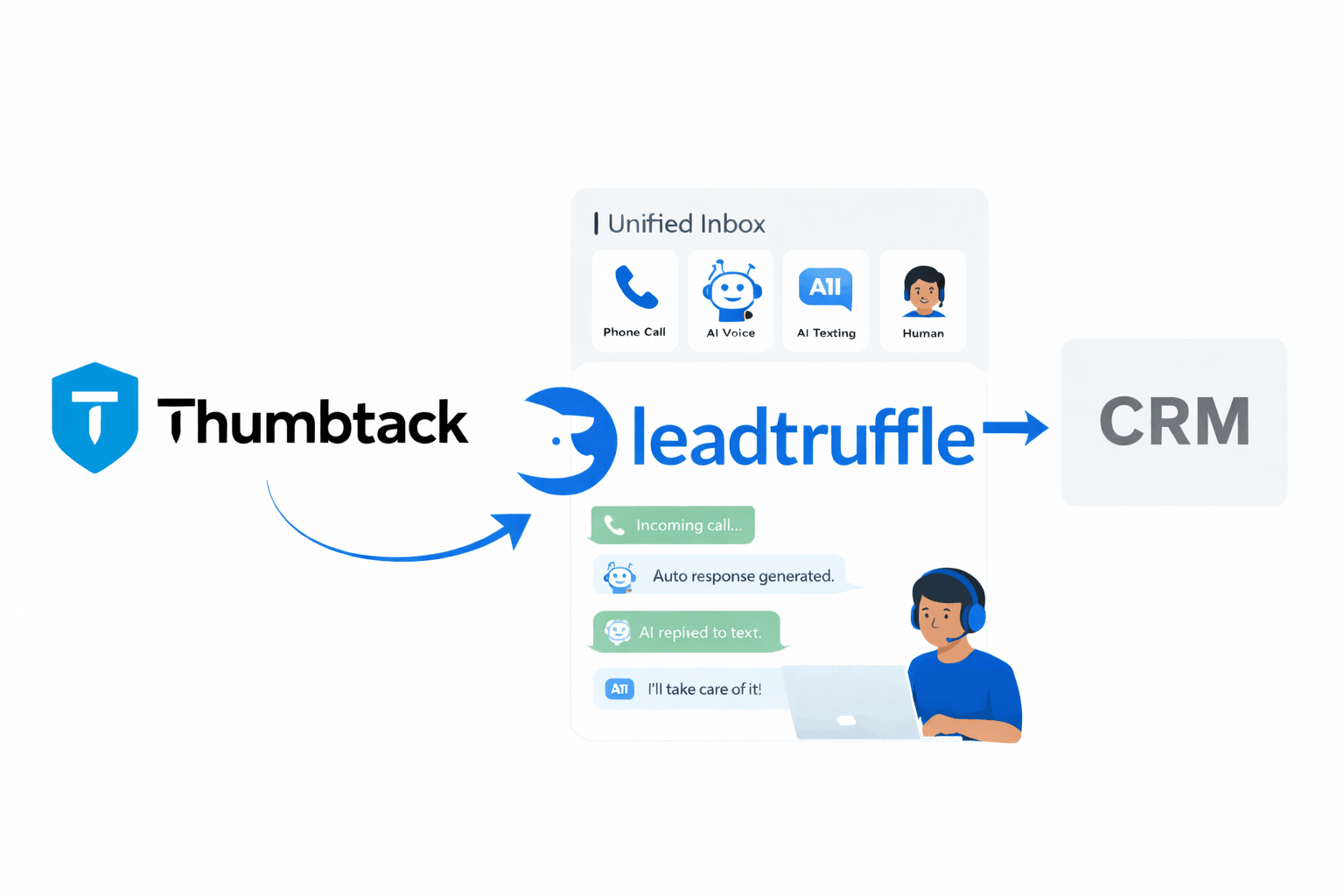

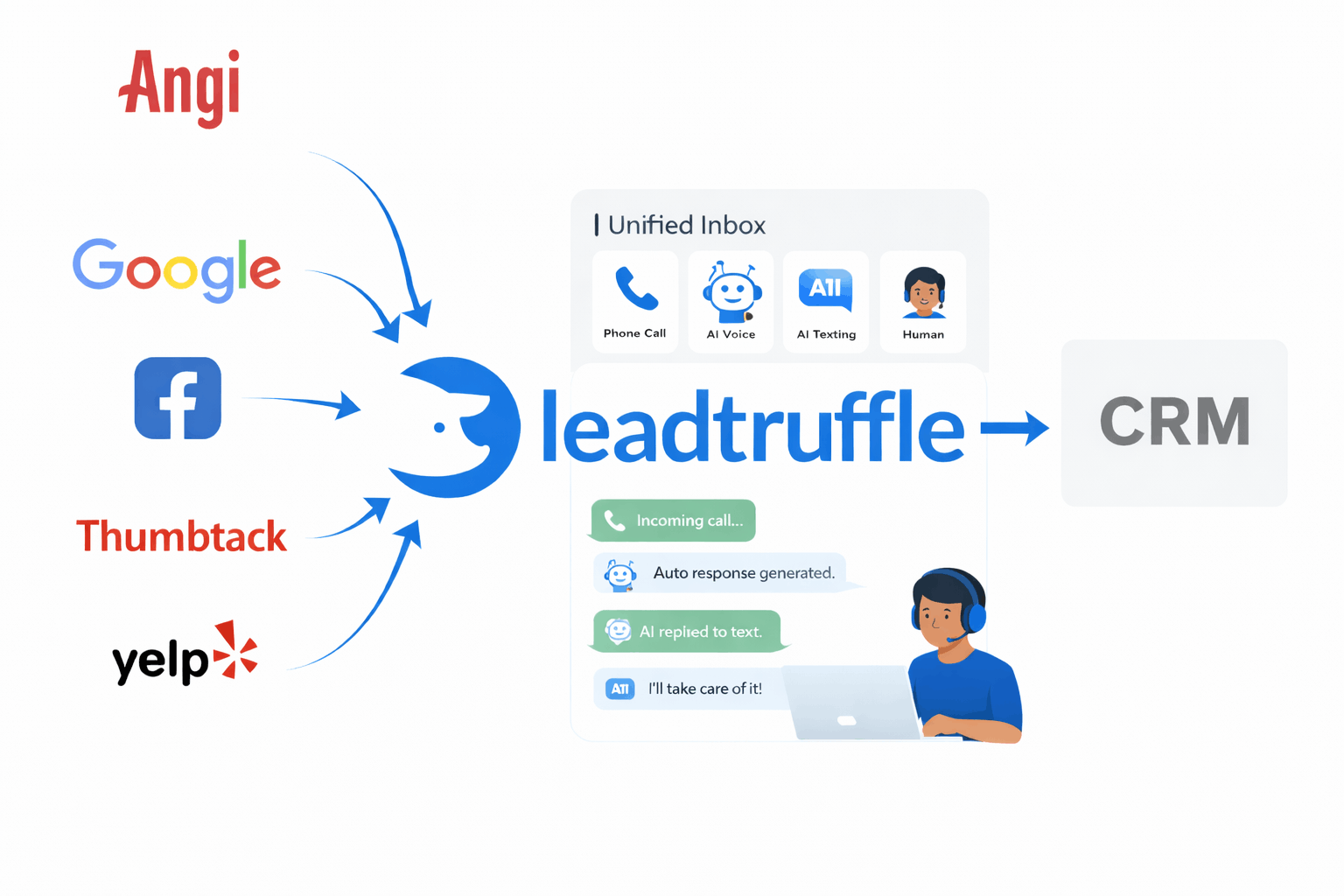

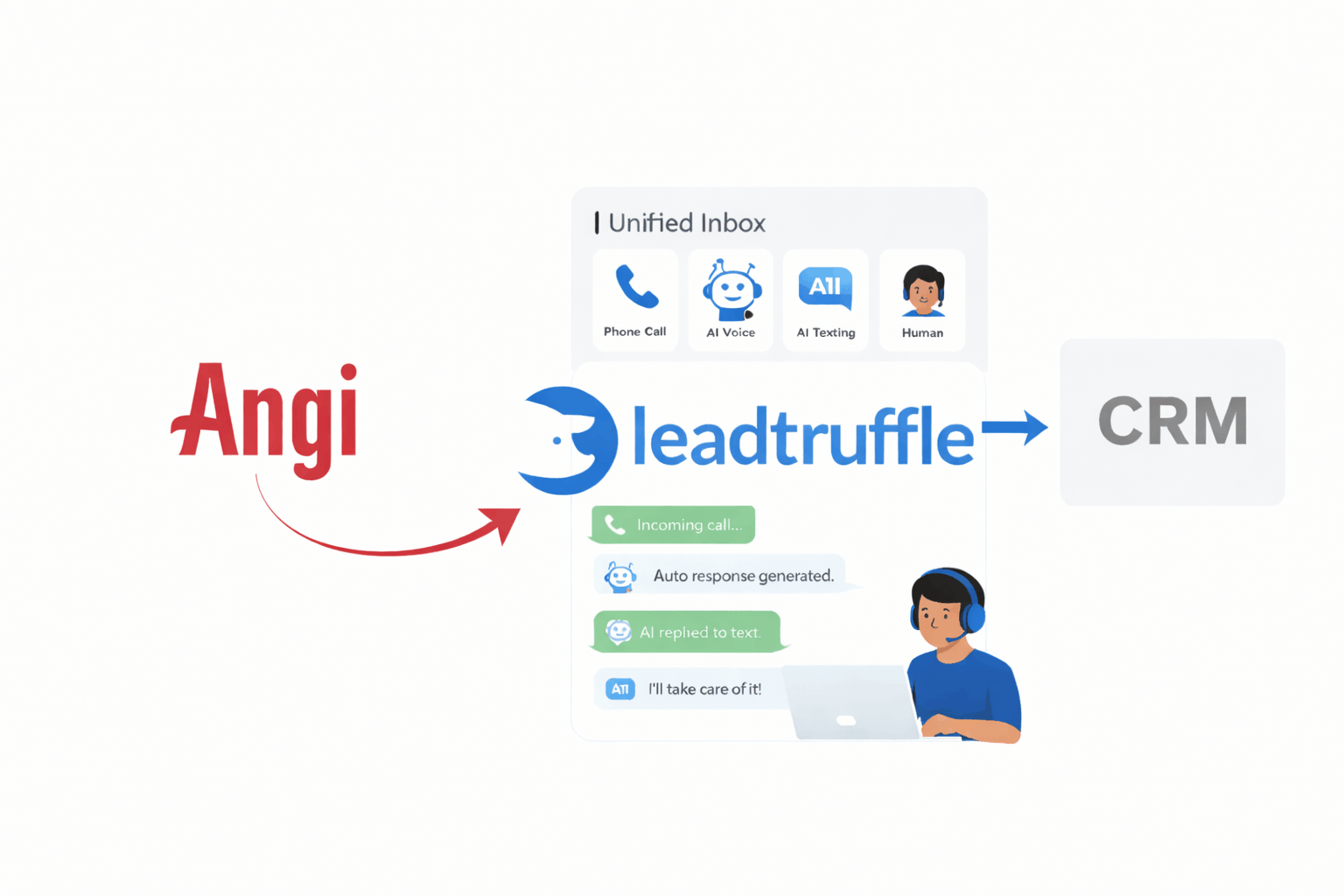

This is where AI lead qualification and automated text-back systems become critical—responding instantly even when you’re on a job site.

Actual Costs by Trade in 2026

Lead Costs by Service Category

| Trade | Cost Per Lead | Notes |

|---|---|---|

| Roofing | $50-$120+ | Highest-value projects |

| HVAC | $45-$100+ | Emergency services at top of range |

| Remodeling/GC | $50-$100+ | Large project scope |

| Plumbing | $40-$85 | Emergency repairs higher |

| Electrical | $35-$80 | Similar to plumbing |

| Garage Door | $35-$75 | Mid-range service |

| Landscaping | $25-$55 | Lower job values |

| Pest Control | $25-$50 | Quick-turn services |

| Locksmith | $25-$50 | Emergency premium applies |

| Cleaning Services | $15-$35 | Lowest ticket items |

| Handyman/Drywall | $15-$40 | Smaller jobs |

Geographic Variations

Major metropolitan areas (New York, Los Angeles, Chicago, Miami, Boston) see 20-25% higher lead costs than smaller markets. Angi does not publish standardized pricing—costs are negotiated individually, creating information asymmetry.

The True Cost of Customer Acquisition

The per-lead cost tells only part of the story. True cost per booked customer through Angi reaches $1,400-$2,500 when accounting for:

- Shared leads reducing conversion probability

- Annual membership fees

- Time spent chasing non-responsive leads

- Competitive pressure reducing margins on won jobs

One marketing agency’s analysis found Angi’s cost per acquisition runs 4-5× higher than SEO or Google Ads.

Budget Recommendations

| Business Size | Monthly Budget | Expected Outcome |

|---|---|---|

| Small/Startup | $300-$500 | Testing, filling gaps |

| Mid-Size | $500-$1,500 | Moderate lead flow |

| Established/Large | $1,500-$2,500+ | High-value trades |

Industry consensus: allocate no more than 10-20% of marketing budget to Angi, treating it as supplemental rather than foundational.

How Angi Compares to Google LSA

Google LSA has emerged as the preferred alternative among contractors:

| Factor | Angi | Google LSA |

|---|---|---|

| Lead exclusivity | Shared (3-8+ contractors) | Exclusive (direct call) |

| Trust signal | ”Angi Approved" | "Google Guaranteed” |

| Conversion rate | 13-20% | 20-25%+ |

| Annual fee | ~$300 | None |

| Contract terms | 1-year, 35% early termination | Month-to-month |

| Lead disputes | Limited (5 per territory) | More flexible credit system |

The key insight: While Angi’s CPL appears lower, Google LSA’s exclusive leads and higher conversion rates often deliver better overall ROI despite higher per-lead costs.

For a deep dive on LSA, see our Complete Guide to Google Local Services Ads.

Tracking Performance and Disputing Leads

Key Metrics to Monitor

Track these metrics religiously:

- Cost per lead by service category

- Contact rate (what percentage of leads answer/respond)

- Conversion rate (leads to booked jobs)

- Cost per acquisition (total spend divided by closed jobs)

- Response time to lead delivery

The Lead Dispute Process

Angi allows requesting credits for invalid leads, but with significant limitations:

- Must attempt contact within 5 minutes for maximum eligibility

- Limited to approximately 5 credits per territory

- Credits apply to future leads, not actual refunds

- Angi frequently rejects disputes, requiring persistent follow-up

Valid dispute reasons include: disconnected phone numbers, leads outside service area, leads for services not offered, and duplicates.

What Contractors Actually Say About Angi

The Predominant Sentiment

Online contractor forums and review platforms show approximately 90% negative sentiment toward Angi/HomeAdvisor. The Trustpilot rating sits at 1.4/5 stars from 37,000+ reviews.

Common complaints:

- Fake/uncontactable leads: Disconnected numbers, no response

- Price shoppers: Homeowners comparing quotes without intent to hire

- Geographic mismatches: Leads hours outside service area

- Service mismatches: Commercial leads to residential contractors

- Shared lead frustration: Same lead sold to 4-16+ contractors

- Billing issues: Charges exceeding budget, difficult cancellation

The Minority Success Stories

Some contractors report success, typically sharing common characteristics:

“The way I do it is: turn the leads off, then after a few hours Angi will send you opportunities that you can look at and accept or decline. I got billed $262 on Friday but made over $2,500 from those leads.”

From a landscaper: “70% of our customers come through HomeAdvisor. You need a professional profile with pictures, get as many reviews as you can, and the biggest thing is calling leads back immediately.”

Conditions Where Angi Works Better

- Rural/low-competition markets with fewer contractors per lead

- New businesses needing quick exposure

- Emergency services where response speed matters most

- Fast-turnaround services (cleaning, pest control, junk removal)

- Contractors who respond within minutes to every lead

Legal Issues and Regulatory Settlements

$14+ Million in Settlements

Angi/HomeAdvisor has faced significant regulatory action:

FTC Settlement ($7.2 million, 2023): False claims about lead quality, misrepresenting that leads came from consumers who intentionally sought HomeAdvisor when many were resold from affiliates.

San Francisco DA Settlement ($6.82 million, 2023): False advertising regarding background checks—ads implied all service professionals were checked, but only business owners were verified.

Angi Services Settlement ($2.95 million, 2025): Inflated earnings claims and undisclosed fees to workers.

The Better Business Bureau shows 2,281 complaints over three years with a “Pattern of Complaints” under active evaluation.

Major Platform Changes in 2024-2025

Key Updates

- Homeowner choice (January 2025): Homeowners now actively select contractors rather than automatic distribution

- IAC spin-off (April 2025): Angi became fully independent public company

- AI Helper launch (June 2025): AI-powered matching with 30% claimed improvement in accuracy

- Platform consolidation: Migrating to single product platform, eliminating separate Leads/Ads systems

Making the Decision: Should You Use Angi?

When Angi Makes Sense

Angi can work as a supplemental lead source (10-20% of marketing budget) for:

- New contractors lacking online presence

- Rural/suburban markets with limited competition

- Emergency service providers where speed creates advantage

- Those who can respond within 5 minutes consistently

- Contractors willing to track ROI and cut spending if results don’t materialize

When to Avoid Angi

Consider alternatives if you:

- Operate in highly competitive urban markets

- Offer high-value services where $1,400+ CPA destroys margins

- Cannot respond within minutes to every lead

- Have established marketing channels already producing leads

The Alternative Stack

Contractors reporting the best results typically combine:

- Google Local Services Ads: Best for exclusive leads with high intent

- SEO and website optimization: Lowest long-term customer acquisition cost

- Google Ads (PPC): More control than lead platforms

- Direct referral systems: Highest conversion, lowest cost

- AI-powered lead response: Ensuring no lead goes unanswered

The Bottom Line

Angi occupies an unusual position: undeniably the largest platform with genuine reach, yet carrying significant regulatory settlements and a business model that creates competition among the contractors paying for leads.

The contractors who succeed share common traits: maniacal response speed, relentless review collection, careful budget management, willingness to dispute every invalid lead, and treatment of the platform as supplemental rather than foundational.

For most contractors in 2026, the data suggests starting with Google LSA for lead quality, investing in SEO for long-term sustainability, and treating Angi as an experimental channel with strict spending limits.

The platform can work—but the odds, contractor experiences, and regulatory history all demand careful, skeptical engagement rather than eager adoption.

Struggling to respond to Angi leads fast enough? LeadTruffle’s AI qualification texts leads back instantly, qualifying them while you’re on a job—so you never lose the speed-to-lead race.